Life Insurance Policy Revitalization

If circumstances are causing you to consider surrendering or replacing your life insurance policy, be sure you are aware of ALL your options.

Today's market offers excellent, money-smart strategies for aligning yesterday's life insurance policies with your needs today - while often preserving your existing investment.

Scottsdale Financial Group's Life Insurance Policy Revitalization is an independent, objective analysis of life insurance products or portfolios which provides you with a customized review, detailing ALL the options best-suited to your circumstances.

The three-step revitalization process (described below) helps everyone involved - policy holder, beneficiary/trustee and trusted advisors - to make fully informed decision as to whether a policy should be revitalized or repurposed.

Before reading on, YOU CAN ALSO:

CLICK HERE for options to consider before surrendering your policy.

CLICK HERE for options to consider before replacing your policy.

CLICK HERE for warning signs your policy is no longer meeting today's needs.

CLICK HERE if you would like to read about others whose circumstances may be similar to yours.

Scottsdale Financial Group's Life Insurance Policy Revitalization 3-Step Process:

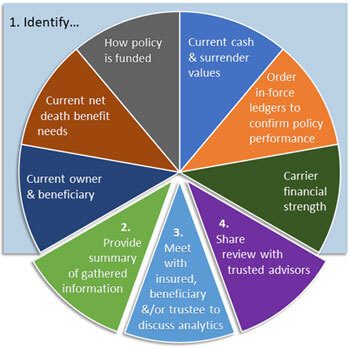

1. We first gather extensive information to fully understand your current needs, circumstances and liquidity goals. With this information, we begin our analytic process, which is shown below.

2. Based on our analytics, we identify and discuss the strengths, weaknesses, opportunities, and threats posed by policy performance and financial strength of the carrier. If the existing policy is not appropriate, we will discuss recommended changes and coordinate policy structure with existing estate planning documents.

3. Design a current assessment of all available options for the insured, beneficiary and trustee to consider.

SURRENDERING your existing life insurance policy is NOT your only option. Through the Life Insurance Policy Revitalization process you may find any number of options that are a much better fit, including:

> Options for Keeping and/or Modifying Your Existing Policy

a. Keep your policy as is

b. Redirect premiums of your policy to your beneficiaries

c. Modify the premium structure

d. Reduced paid-up option

> Options for Surrending or Replacement Alternative

a. Surrender existing policy

b. Gift policy to your favoriate charity

c. Replace the policy with a better performing contract

REPLACING your existing life insurance policy is NOT your only option. Through the Life Insurance Policy Revitalization process you may find any number of options that are a much better fit, including:

> Options for repurposing your existing policy:

a. Modify your current premium structure

b. Eliminate unnecessary/expensive existing riders

c. Redirect dividends to reduct current premiums

d. Restructure owner and beneficiary

e. Transfer existing policy to an income-producing annuity

f. Transfer existing cash value to a hybrid life/LTC policy

g. Surrender existing policy and invest cash value in an investment portfolio

h. Replace existing policy with a better performing contract

WARNING SIGNS

You are NOT alone. The fact is, the ground is shifting under many permanent life insurance policies. You may be seeing some of the same warning signs which triggered others to seek out all of their available options through the Life Insurance Policy Revitalization process.

> Policy rate increase notifications are being received

> Estate tax changes have you weighing policy options

> Past policy performance is well below expectations

> Your policy is no longer needed

> Today's insurance needs are not being met

> Your agent recommends policy replacement

THE EXPERIENCE OF OTHERS

- "I didn't need the $2 million death benefit any more and didn't want to keep paying its $20,000 annual premium. I thought my only option was to drop my existing life policy for its $64,000 cash surrender value. Scottsdale Financial Group provided me with eight additional options to consider. We chose a reduced paid-up option for $847,000 of coverage with no future premiums. We were impressed with the firm's processes and thrilled with the option we didn't know we had."

- "I was being solicited to replace my $10 million policy. It had loans, an increasing term rider cost and was not in compliance with my life insurance trust. Scottsdale Financial Group suggested a number of options. We were relieved to find out we could restructure the existing contract, drop the expensive riders and receive assistance in bringing the policy back into compliance. We saved hundreds of thousands of dollars in commissions. Scottsdale Financial's professionalism and follow-through made it easy."

- "The insurance carrier's letters were confusing and had us concerned that my parent's life insurance portfolio was falling apart. We figured if we went to another company for advice we would just end up being sold a new policy. We were surprised. Scottsdale Financial Group identified how we could restructure the existing contracts. Rather than having a new policy, we have peace of mind knowing everything is locked in. Extremely impressed with this firm and our experience."